Unlocking the Ocean’s Riches: How Abyssal Robotics Are Transforming Deep-Sea Mineral Exploration in 2025 and Beyond. Discover the Technologies, Market Forces, and Future Opportunities Shaping the Next Frontier Underwater.

- Executive Summary: The State of Abyssal Robotics in 2025

- Market Size and Growth Forecasts Through 2030

- Key Players and Industry Collaborations

- Core Technologies: Robotics, AI, and Sensor Innovations

- Operational Challenges and Solutions in Extreme Environments

- Regulatory Landscape and Environmental Considerations

- Case Studies: Leading Projects and Deployments

- Investment Trends and Funding Landscape

- Future Outlook: Emerging Applications and Market Opportunities

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: The State of Abyssal Robotics in 2025

In 2025, abyssal robotics has emerged as a cornerstone technology for deep-sea mineral exploration, driven by the increasing demand for critical minerals such as cobalt, nickel, copper, and rare earth elements. These resources, essential for batteries, renewable energy infrastructure, and electronics, are found in polymetallic nodules, seafloor massive sulfides, and cobalt-rich crusts at depths often exceeding 4,000 meters. The extreme conditions of the abyssal zone—high pressure, low temperatures, and total darkness—necessitate advanced robotic solutions for safe, efficient, and minimally invasive exploration.

Leading the field are Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), which have seen significant technological advancements in navigation, sensor integration, and endurance. Companies such as Saab and Oceaneering International have deployed deep-rated ROVs capable of high-resolution mapping, sampling, and real-time data transmission. Saab’s Seaeye series and Oceaneering International’s Magnum and Millennium ROVs are frequently utilized in mineral prospecting campaigns, offering modular payloads for geochemical and geophysical analysis.

AUVs, such as those developed by Kongsberg and Hydroid (a Kongsberg company), are increasingly deployed for autonomous seafloor mapping and environmental baseline studies. These vehicles can operate for extended periods, covering vast areas with multibeam sonar, sub-bottom profilers, and magnetometers, providing critical data for resource estimation and environmental impact assessments.

The past year has seen a surge in pilot projects and commercial contracts, particularly in the Clarion-Clipperton Zone (CCZ) of the Pacific Ocean, where international consortia are leveraging robotic fleets for large-scale mineral surveys. The International Seabed Authority (ISA) continues to regulate exploration activities, mandating robust environmental monitoring—an area where robotic platforms excel by enabling continuous, non-intrusive data collection.

Looking ahead, the outlook for abyssal robotics is marked by rapid innovation. Key trends include the integration of artificial intelligence for adaptive mission planning, swarm robotics for coordinated surveys, and the development of hybrid vehicles capable of both autonomous and remotely operated modes. As regulatory frameworks evolve and environmental scrutiny intensifies, robotics manufacturers are prioritizing low-impact sampling tools and real-time environmental monitoring systems.

In summary, 2025 marks a pivotal year for abyssal robotics in deep-sea mineral exploration, with industry leaders such as Saab, Oceaneering International, and Kongsberg setting the pace for technological progress and operational deployment. The sector is poised for further growth as demand for critical minerals accelerates and robotic capabilities continue to expand.

Market Size and Growth Forecasts Through 2030

The market for abyssal robotics—autonomous and remotely operated vehicles (AUVs and ROVs) designed for deep-sea mineral exploration—is poised for significant growth through 2030, driven by increasing demand for critical minerals such as cobalt, nickel, copper, and rare earth elements. These minerals are essential for batteries, renewable energy technologies, and electronics, fueling interest in deep-sea mining as terrestrial resources become scarcer.

As of 2025, the deployment of advanced robotics in deep-sea environments is transitioning from pilot projects to early-stage commercial operations. Companies such as Saab (through its Saab Seaeye division), Schilling Robotics (a subsidiary of TechnipFMC), and Oceaneering International are recognized leaders in the design and manufacture of deepwater ROVs and AUVs. These systems are increasingly tailored for mineral prospecting, environmental baseline studies, and subsea sampling at depths exceeding 4,000 meters.

The International Seabed Authority (ISA) has issued over 30 exploration contracts for polymetallic nodules, sulfides, and cobalt-rich crusts in the Clarion-Clipperton Zone and other deep-ocean regions, catalyzing demand for specialized robotics. In 2024–2025, several contractors—including The Metals Company and DeepGreen Metals (now part of The Metals Company)—have conducted large-scale robotic sampling campaigns, demonstrating the operational viability of abyssal robotics for mineral resource assessment.

Market growth is further supported by technological advances in sensor integration, AI-driven navigation, and modular vehicle design, enabling longer missions and more precise data collection. Kongsberg Maritime and Fugro are notable for their development of high-endurance AUVs equipped with geophysical and geochemical survey payloads, which are increasingly adopted by mining contractors and research consortia.

Looking ahead to 2030, the abyssal robotics market is expected to expand at a double-digit compound annual growth rate, with the Asia-Pacific and North American regions leading in adoption due to active exploration licenses and government-backed initiatives. The pace of market expansion will depend on regulatory developments, environmental considerations, and the commercial success of initial mining operations. As deep-sea mining moves toward production phases, demand for robust, scalable robotic solutions is projected to accelerate, positioning established manufacturers and innovative startups at the forefront of this emerging sector.

Key Players and Industry Collaborations

The landscape of abyssal robotics for deep-sea mineral exploration in 2025 is shaped by a dynamic interplay of established subsea technology firms, emerging robotics startups, and strategic collaborations with mining and energy majors. As the demand for critical minerals intensifies, several key players are advancing the capabilities of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) to operate at extreme depths, often exceeding 6,000 meters.

Among the industry leaders, Saab continues to be a prominent force with its Sabertooth hybrid AUV/ROV platform, which is widely deployed for deep-sea survey and intervention tasks. The company’s ongoing partnerships with mineral exploration consortia and offshore engineering firms are expected to expand in 2025, focusing on modular payloads for geophysical and geochemical sensing.

Another major player, Oceaneering International, leverages its extensive fleet of work-class ROVs and advanced control systems to support mineral prospecting missions. The company’s collaborations with deep-sea mining ventures and research institutions are driving the integration of real-time data analytics and machine learning for improved resource mapping and environmental monitoring.

In Europe, Schilling Robotics (a division of TechnipFMC) is recognized for its ultra-deepwater ROVs, which are increasingly adapted for mineral sampling and seafloor mapping. Their technology is often selected for pilot projects in the Clarion-Clipperton Zone and other high-potential regions.

Emerging companies such as Kongsberg Maritime are also making significant strides, particularly with their HUGIN AUV series, which is utilized for high-resolution seabed imaging and mineral deposit characterization. Kongsberg’s collaborations with geological survey agencies and mining license holders are expected to intensify as exploration activities accelerate.

Industry collaborations are a defining feature of the sector in 2025. Joint ventures between robotics manufacturers, mining companies, and research organizations are commonplace, aiming to address technical, regulatory, and environmental challenges. For example, partnerships between Saab and national geological institutes are facilitating the development of new sensor suites tailored for polymetallic nodule and sulfide exploration.

Looking ahead, the next few years are likely to see further consolidation among technology providers and increased cross-sector alliances, as stakeholders seek to de-risk operations and comply with evolving international regulations. The integration of AI-driven autonomy, real-time environmental monitoring, and modular robotics platforms will be central to the industry’s outlook, positioning these key players at the forefront of the deep-sea mineral exploration value chain.

Core Technologies: Robotics, AI, and Sensor Innovations

Abyssal robotics are at the forefront of deep-sea mineral exploration, leveraging advanced technologies in robotics, artificial intelligence (AI), and sensor systems to access and analyze the ocean’s most inaccessible regions. As of 2025, the sector is witnessing rapid advancements, driven by the increasing demand for critical minerals such as cobalt, nickel, and rare earth elements essential for renewable energy and electronics.

Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) are the primary robotic platforms deployed for deep-sea mineral prospecting. Companies like Saab and Oceaneering International are leading suppliers of ROVs capable of operating at depths exceeding 6,000 meters, equipped with high-definition cameras, manipulator arms, and modular payload bays for scientific instruments. Saab’s Seaeye series, for example, is widely used for both commercial and scientific deep-sea missions.

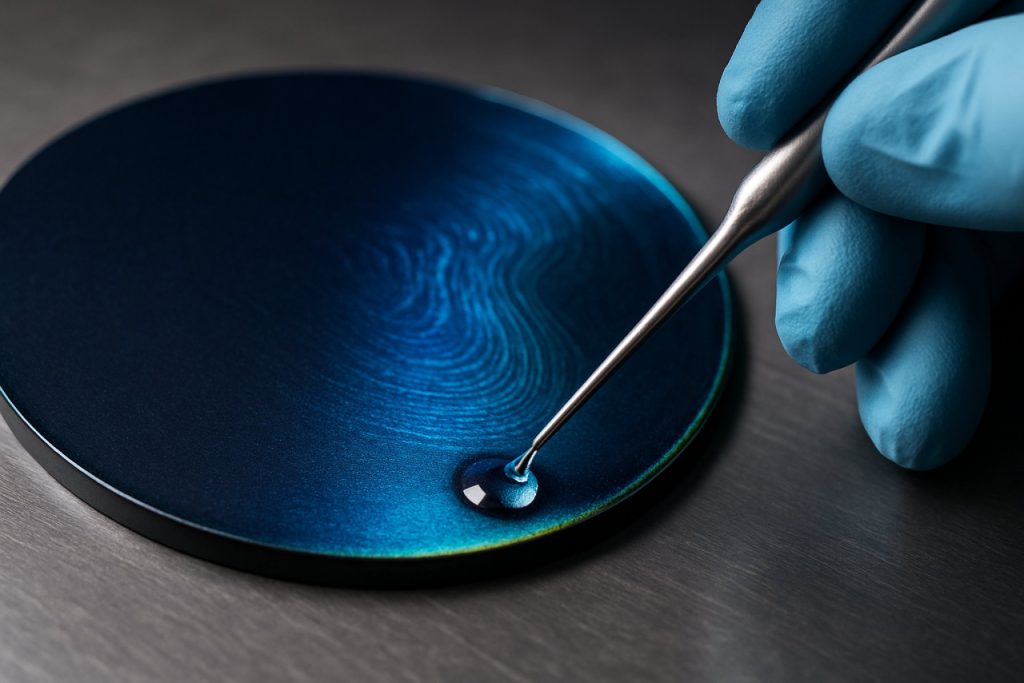

AUVs, such as those developed by Kongsberg and Hydroid (a Kongsberg company), are increasingly utilized for autonomous mapping and mineral detection. These vehicles are equipped with advanced sonar, magnetometers, and chemical sensors, enabling high-resolution seafloor mapping and geochemical analysis. The integration of AI-driven navigation and data processing allows these AUVs to adaptively plan survey routes and identify promising mineral deposits in real time.

Sensor innovation is a critical enabler for abyssal robotics. Companies such as Teledyne Marine provide a suite of sensors, including multi-beam echo sounders, sub-bottom profilers, and in-situ water chemistry analyzers, which are essential for characterizing mineral-rich zones and assessing environmental conditions. The latest sensor packages are designed for modular integration, allowing rapid reconfiguration of robotic platforms for specific exploration missions.

AI and machine learning are increasingly embedded in both vehicle control systems and data analytics workflows. These technologies enable real-time anomaly detection, automated feature recognition in sonar and camera data, and predictive modeling of mineral deposit locations. Industry collaborations, such as those between Kongsberg and leading mining companies, are accelerating the deployment of AI-powered exploration fleets.

Looking ahead, the next few years are expected to see further miniaturization of sensor payloads, increased endurance and autonomy of robotic vehicles, and the emergence of swarm robotics for large-scale, coordinated surveys. These innovations will be pivotal in reducing exploration costs, improving data quality, and minimizing environmental impact, positioning abyssal robotics as a cornerstone of sustainable deep-sea mineral resource development.

Operational Challenges and Solutions in Extreme Environments

Abyssal robotics, particularly Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), are at the forefront of deep-sea mineral exploration in 2025. These robotic systems are engineered to withstand the extreme pressures, low temperatures, and corrosive conditions found at depths exceeding 4,000 meters. However, operational challenges remain significant, driving ongoing innovation and collaboration among industry leaders.

One of the primary challenges is the immense hydrostatic pressure, which can exceed 400 atmospheres at abyssal depths. Robotics manufacturers such as Saab and Oceaneering International have developed titanium and syntactic foam housings to protect sensitive electronics and maintain buoyancy. These materials are now standard in new-generation ROVs and AUVs, enabling longer and deeper missions.

Another operational hurdle is reliable power supply and endurance. Traditional tethered ROVs are limited by cable length and risk entanglement, while AUVs face battery life constraints. In 2025, companies like Kongsberg are advancing lithium-ion battery technologies and hybrid power systems, extending mission durations to several days. Some systems are also experimenting with subsea docking stations for mid-mission recharging and data transfer, a solution being piloted by Saab and Kongsberg.

Navigation and communication in the deep sea present further difficulties due to the absence of GPS signals and the attenuation of radio waves underwater. To address this, robotics firms are integrating advanced inertial navigation systems, Doppler velocity logs, and acoustic positioning technologies. Kongsberg and Oceaneering International have deployed AUVs equipped with high-precision sonar and real-time data relays, allowing for accurate mapping and mineral target identification even in complex terrains.

Corrosive saltwater and biofouling also threaten the longevity and reliability of robotic systems. To mitigate these effects, manufacturers are employing advanced coatings, sacrificial anodes, and self-cleaning sensor housings. Saab and Oceaneering International are leading efforts to develop modular, easily serviceable components, reducing downtime and maintenance costs.

Looking ahead, the next few years are expected to see further integration of artificial intelligence and machine learning for autonomous decision-making, adaptive mission planning, and real-time anomaly detection. Industry leaders are also collaborating with regulatory bodies to ensure that robotic operations minimize environmental impact, a critical consideration as commercial deep-sea mining projects move closer to reality.

Regulatory Landscape and Environmental Considerations

The regulatory landscape for abyssal robotics in deep-sea mineral exploration is rapidly evolving as technological capabilities outpace existing frameworks. In 2025, the International Seabed Authority (International Seabed Authority), established under the United Nations Convention on the Law of the Sea (UNCLOS), remains the primary body responsible for regulating mineral-related activities in international waters. The ISA has been working to finalize the Mining Code, a comprehensive set of rules governing the exploration and potential exploitation of deep-sea minerals, including the use of advanced robotic systems. The Mining Code is expected to address environmental protection, technology standards, and monitoring requirements, with a particular focus on the deployment of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) for exploration and environmental baseline studies.

Several countries with claims to extended continental shelves, such as Norway, Japan, and China, are also developing national regulations to oversee deep-sea mineral activities within their exclusive economic zones (EEZs). These frameworks increasingly require environmental impact assessments (EIAs) and the integration of real-time monitoring technologies, many of which are enabled by robotics. For example, Kongsberg Gruppen, a leading Norwegian technology company, supplies AUVs and ROVs equipped with advanced sensors for both mineral prospecting and environmental monitoring, supporting compliance with emerging regulatory requirements.

Environmental considerations are at the forefront of regulatory discussions. The potential impacts of deep-sea mining—such as sediment plumes, habitat disruption, and biodiversity loss—have prompted calls for robust precautionary measures. Robotic platforms are increasingly being used to collect high-resolution data on benthic ecosystems, enabling more accurate environmental baselines and ongoing impact assessments. Companies like Saab and Oceaneering International are actively developing and deploying robotic systems designed for minimal environmental disturbance and enhanced data collection capabilities.

Looking ahead, the next few years are likely to see the implementation of stricter operational protocols and real-time environmental monitoring mandates, with robotics playing a central role in compliance. The ISA is expected to finalize and begin enforcing the Mining Code, while national authorities may introduce additional requirements for transparency and data sharing. Industry stakeholders are increasingly collaborating with environmental organizations and research institutions to develop best practices for robotic operations in sensitive deep-sea environments. As regulatory clarity improves, investment in abyssal robotics is anticipated to accelerate, with a strong emphasis on technologies that support both resource discovery and environmental stewardship.

Case Studies: Leading Projects and Deployments

The deployment of abyssal robotics for deep-sea mineral exploration has accelerated in 2025, with several high-profile projects demonstrating the capabilities and challenges of these advanced systems. These case studies highlight the integration of remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and hybrid platforms in mapping, sampling, and environmental monitoring of mineral-rich seabed areas.

One of the most prominent initiatives is the ongoing work by Kongsberg Maritime, a Norwegian technology company specializing in marine robotics. In 2025, Kongsberg’s HUGIN AUVs have been deployed in the Clarion-Clipperton Zone (CCZ) of the Pacific Ocean, a region known for its vast polymetallic nodule fields. These AUVs are equipped with high-resolution sonar, sub-bottom profilers, and geochemical sensors, enabling detailed mapping and resource assessment at depths exceeding 4,000 meters. The data collected supports both resource estimation and environmental baseline studies, which are prerequisites for any future extraction activities.

Another significant project involves Saab, whose Sabertooth hybrid AUV/ROV systems have been utilized by several exploration consortia for both survey and intervention tasks. In 2025, Sabertooth vehicles have been instrumental in the Indian Ocean, where they performed precision sampling of seafloor massive sulfides (SMS) and manganese crusts. The hybrid design allows for both autonomous survey missions and tethered operations for real-time control, making them versatile tools for mineral prospecting in complex terrains.

In the Pacific, Schilling Robotics (a division of TechnipFMC) continues to supply heavy-duty ROVs for deep-sea exploration. Their systems, such as the UHD and HD ROVs, are being used by international mining contractors to conduct geotechnical sampling and in-situ testing of nodule fields. These ROVs are equipped with advanced manipulators and sensor suites, enabling precise collection of mineral samples and environmental data at depths up to 6,000 meters.

Looking ahead, the outlook for abyssal robotics in mineral exploration is marked by increasing collaboration between technology providers and resource developers. The International Seabed Authority (ISA) has emphasized the need for robust environmental monitoring, driving demand for robotics capable of long-duration, low-impact surveys. As regulatory frameworks evolve, the integration of real-time data transmission, AI-driven navigation, and modular sensor payloads is expected to further enhance the efficiency and environmental stewardship of deep-sea mineral exploration projects.

Investment Trends and Funding Landscape

The investment landscape for abyssal robotics in deep-sea mineral exploration is experiencing significant momentum in 2025, driven by the growing demand for critical minerals essential to the energy transition and advanced technologies. The sector is characterized by a blend of established subsea technology firms, emerging robotics startups, and strategic partnerships with mining and energy conglomerates.

Major subsea robotics manufacturers such as Saab and Oceaneering International continue to attract substantial capital for the development and deployment of Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) tailored for deep-sea mineral prospecting. Saab’s Seaeye division, for example, has expanded its portfolio of deep-rated ROVs, with recent investments supporting enhanced sensor integration and AI-driven navigation systems. Similarly, Oceaneering International has reported increased funding for its next-generation Freedom AUV platform, designed for extended missions in challenging abyssal environments.

Venture capital and private equity interest in the sector has intensified, particularly in startups developing novel robotics and sensor technologies. Companies such as Kongsberg Gruppen are leveraging both internal R&D and external partnerships to accelerate innovation in deep-sea robotics, with a focus on modularity and data analytics capabilities. In 2025, several early-stage firms have secured multi-million dollar seed and Series A rounds, often with participation from strategic investors in the mining and energy sectors seeking to secure future supply chains for cobalt, nickel, and rare earth elements.

Public funding and government-backed initiatives are also shaping the investment landscape. The European Union and select Asia-Pacific governments have announced new grant programs and public-private partnerships to advance sustainable deep-sea exploration technologies, with a strong emphasis on environmental monitoring and responsible resource extraction. These initiatives are channeling funds into robotics R&D, pilot deployments, and the development of regulatory frameworks.

Looking ahead, the outlook for investment in abyssal robotics remains robust. The convergence of mineral supply concerns, technological advances, and evolving regulatory clarity is expected to sustain high levels of funding through the late 2020s. However, investors are increasingly attentive to environmental, social, and governance (ESG) considerations, with funding often contingent on demonstrable commitments to minimizing ecological impact and ensuring transparency in operations.

Future Outlook: Emerging Applications and Market Opportunities

The future of abyssal robotics for deep-sea mineral exploration is poised for significant growth and technological advancement in 2025 and the coming years. As global demand for critical minerals—such as cobalt, nickel, copper, and rare earth elements—continues to rise, the need for efficient, safe, and environmentally responsible exploration methods is driving rapid innovation in underwater robotics.

Leading manufacturers and technology developers are accelerating the deployment of advanced remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) specifically designed for deep-sea mineral prospecting. Companies like Saab and Kongsberg Gruppen are at the forefront, offering modular, high-endurance robotic platforms capable of operating at depths exceeding 6,000 meters. These systems are equipped with sophisticated sensor suites, including high-resolution sonar, magnetometers, and geochemical analyzers, enabling precise mapping and sampling of polymetallic nodules, seafloor massive sulfides, and cobalt-rich crusts.

In 2025, several pilot projects are expected to transition from exploration to pre-commercial testing. For instance, DeepOcean and Ocean Infinity are expanding their fleets of AUVs and ROVs to support mineral resource assessments in the Clarion-Clipperton Zone (CCZ) of the Pacific Ocean, a region estimated to contain billions of tons of valuable minerals. These companies are collaborating with international mining consortia and regulatory bodies to ensure compliance with emerging environmental standards and best practices.

Emerging applications for abyssal robotics extend beyond mineral detection and sampling. In the near term, robotic systems are expected to play a critical role in environmental baseline studies, real-time monitoring of mining impacts, and the deployment of in-situ remediation technologies. The integration of artificial intelligence and machine learning is enhancing the autonomy and data-processing capabilities of these platforms, allowing for adaptive mission planning and rapid decision-making in complex underwater environments.

Market opportunities are expanding as governments and private sector stakeholders invest in sustainable resource development. The International Seabed Authority is anticipated to finalize regulations for commercial deep-sea mining, which will likely catalyze further investment in robotic technologies. As a result, the market for abyssal robotics is projected to experience robust growth, with new entrants and established players alike seeking to capitalize on the increasing demand for deep-sea mineral resources and the technologies required to access them responsibly.

Strategic Recommendations for Stakeholders

As the deployment of abyssal robotics accelerates in deep-sea mineral exploration, stakeholders—including mining companies, technology developers, regulators, and environmental groups—must adopt strategic approaches to maximize benefits while mitigating risks. The following recommendations are tailored to the current landscape in 2025 and the anticipated developments over the next few years.

- Invest in Next-Generation Robotics and AI: Stakeholders should prioritize investment in advanced remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) equipped with AI-driven navigation, sensor fusion, and real-time data analytics. Companies such as Saab and Kongsberg Gruppen are leading the development of modular, deep-rated robotic platforms capable of operating at depths exceeding 6,000 meters, with enhanced endurance and payload flexibility.

- Foster Cross-Sector Collaboration: Strategic partnerships between robotics manufacturers, mining operators, and marine research institutions are essential. Collaborative projects, such as those involving Schilling Robotics (a subsidiary of TechnipFMC) and Ocean Infinity, have demonstrated the value of integrating commercial and scientific expertise to improve operational efficiency and environmental monitoring.

- Prioritize Environmental Stewardship: With increasing scrutiny from international regulators and NGOs, stakeholders must implement robust environmental baseline studies and continuous monitoring using robotic platforms. The International Seabed Authority (ISA) is expected to tighten regulations on deep-sea mining activities, making compliance and transparent reporting critical for project approval and social license to operate.

- Develop Data Management and Cybersecurity Protocols: The vast datasets generated by abyssal robotics require secure, scalable data infrastructure. Stakeholders should adopt industry best practices for data integrity, sharing, and protection against cyber threats, especially as remote operations and cloud-based analytics become standard.

- Engage in Policy Advocacy and Standards Development: Active participation in shaping international standards and regulatory frameworks will ensure that industry needs are represented. Engagement with bodies such as the ISA and collaboration with technology leaders like Fugro—which is advancing deep-sea survey and robotics integration—can help align operational practices with evolving global norms.

By embracing these strategic recommendations, stakeholders can position themselves at the forefront of the rapidly evolving abyssal robotics sector, balancing commercial opportunity with responsible stewardship of the deep-sea environment.

Sources & References

- Saab

- Oceaneering International

- Kongsberg

- The Metals Company

- Fugro

- Teledyne Marine

- International Seabed Authority

- DeepOcean

- Ocean Infinity