Table of Contents

- Executive Summary: 2025 Market Snapshots & Key Insights

- Zirconate Thin-Film Nanocoatings: Core Technology Overview

- Top Manufacturers & Leading Innovators (2025 Edition)

- Emerging Applications: Electronics, Energy, Aerospace, and Beyond

- Competitive Landscape: Company Strategies and Recent Partnerships

- Market Forecasts: Growth Projections for 2025–2030

- Critical Drivers: Industry Demand, Regulatory Trends & Sustainability

- Barriers & Challenges: Technical, Economic, and Supply-Chain Risks

- Breakthrough Research & Patents: Latest Developments from Industry Leaders

- Future Outlook: Disruptive Trends & Investment Hotspots Through 2030

- Sources & References

Executive Summary: 2025 Market Snapshots & Key Insights

Zirconate thin-film nanocoatings are gaining significant traction in advanced material markets in 2025, primarily owing to their superior thermal stability, corrosion resistance, and dielectric properties. These attributes are crucial for applications spanning electronics, energy, aerospace, and biomedical sectors. In the current landscape, demand for high-performance coatings that can withstand aggressive environments is accelerating the adoption of zirconate-based solutions, particularly in microelectronics and high-temperature engineering substrates.

Recent investments and technology announcements from leading ceramics and advanced materials suppliers signal strong market momentum. Companies such as Tosoh Corporation and Ferro Corporation have expanded their portfolios to include customized zirconate compositions, catering to the evolving needs of electronics and energy storage manufacturers. These nanocoatings are especially valued for their ability to enhance the life cycle and reliability of components exposed to high voltages, humidity, and thermal cycling.

Another key driver in 2025 is the electrification of transport and infrastructure, fueling demand for robust dielectric and barrier coatings. Zirconate thin films are increasingly specified in multilayer ceramic capacitors (MLCCs), sensors, and solid oxide fuel cells, as exemplified by ongoing research collaborations and pilot projects initiated by Materion Corporation. The biocompatibility and chemical inertness of zirconate coatings are also drawing attention in the medical device industry, contributing to surface modifications for implants and diagnostic equipment.

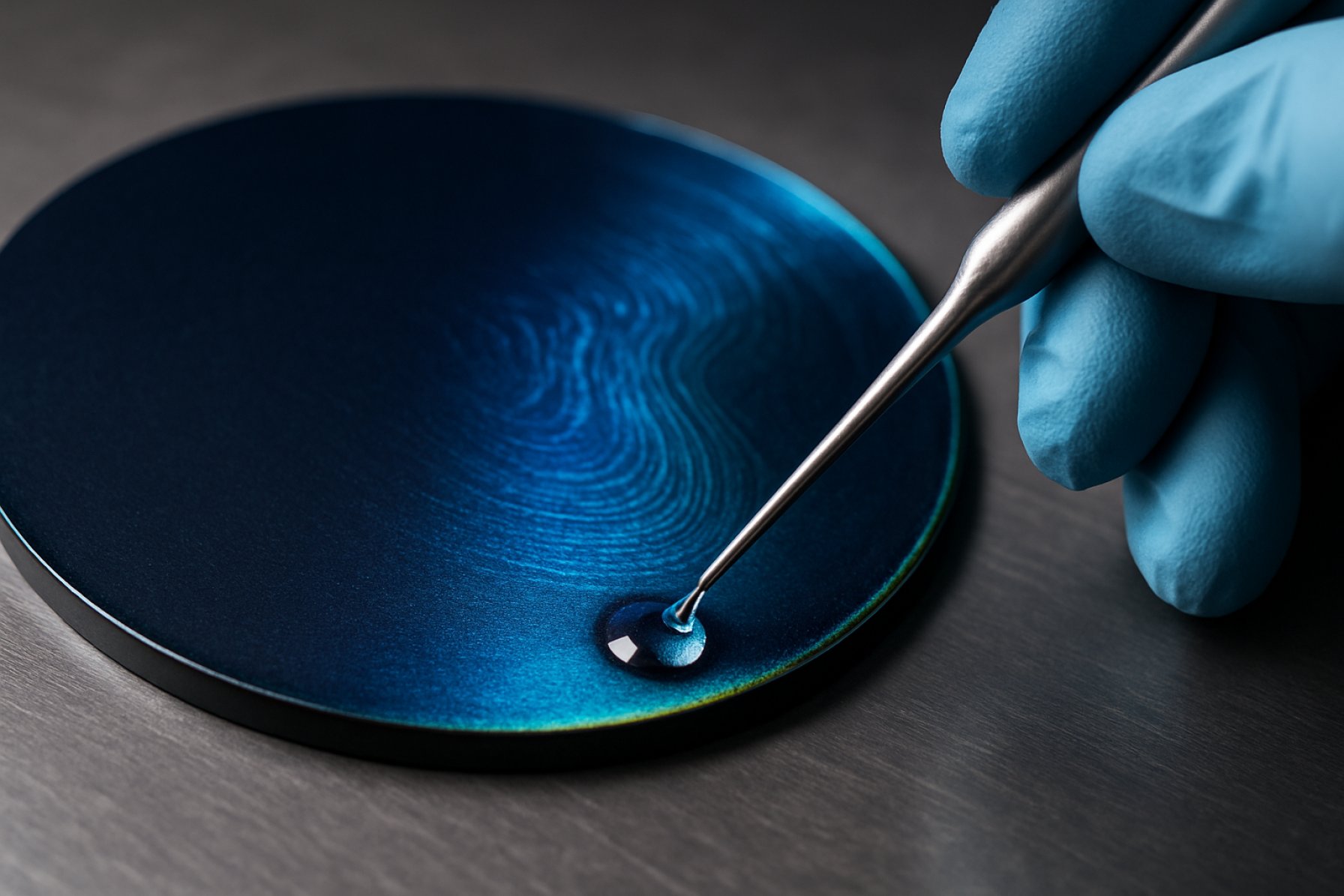

Market activity is further stimulated by emerging process innovations. Atomic layer deposition (ALD) and pulsed laser deposition (PLD) are being refined for large-scale, uniform, and defect-free zirconate coatings, as noted in recent technical updates from ULVAC, Inc.. These advancements are pivotal in addressing scalability and reproducibility challenges that have historically limited broader commercial adoption.

Looking ahead, the outlook for zirconate thin-film nanocoatings remains robust through the next several years. As semiconductor miniaturization and clean energy systems demand ever more resilient materials, manufacturers are expected to intensify R&D efforts, often in partnership with academic and governmental research institutions. Regulatory emphasis on product longevity and environmental robustness will likely further expand use cases, making zirconate nanocoatings a strategic material focus for 2025 and beyond.

Zirconate Thin-Film Nanocoatings: Core Technology Overview

Zirconate thin-film nanocoatings are emerging as a critical class of advanced materials in 2025, driven by their exceptional chemical stability, corrosion resistance, and dielectric properties. These coatings are typically composed of zirconium-based compounds, most commonly zirconium dioxide (ZrO₂), deposited as nanometer-thick films onto substrates through techniques such as atomic layer deposition (ALD), chemical vapor deposition (CVD), and sol-gel processing. The versatility of these methods allows precise control over coating thickness, uniformity, and crystallinity, which is essential for meeting the stringent requirements of sectors such as microelectronics, energy, and aerospace.

In microelectronics, zirconate nanocoatings serve as high-k dielectric layers in semiconductor devices, enabling further miniaturization and improved performance of transistors and capacitors. With the push towards sub-5 nm nodes in integrated circuits, the use of zirconium-based oxides is expected to increase due to their superior insulating properties and compatibility with silicon-based processes. Companies like Applied Materials and Lam Research are actively engaged in supplying equipment and process solutions for the precise deposition of such nanocoatings in the semiconductor industry.

In the energy sector, zirconate thin films are being incorporated into solid oxide fuel cells (SOFCs) and advanced battery systems. Their ionic conductivity and thermal stability contribute to higher operational efficiencies and longer device lifetimes. Leading manufacturers such as Tosoh Corporation and Saint-Gobain produce high-purity zirconia powders and materials that serve as feedstock for thin-film applications, supporting innovations in clean energy technologies.

Corrosion protection is another significant application area, particularly in aerospace and automotive industries where lightweight alloys require robust surface protection. Zirconate nanocoatings, due to their dense and adherent nature, provide effective barriers against aggressive environments. Companies like Chemetall are developing next-generation surface treatment solutions incorporating zirconium compounds as environmentally friendly alternatives to traditional chromate-based systems.

Looking ahead, the outlook for zirconate thin-film nanocoatings is strongly positive. Ongoing research into multi-functional coatings—combining zirconates with other oxides or dopants—aims to enhance properties such as self-healing, wear resistance, and catalytic activity. Collaboration between industrial players and academic institutions is expected to accelerate innovation and commercialization in the next few years, positioning zirconate nanocoatings as a foundation for next-generation materials solutions across high-technology domains.

Top Manufacturers & Leading Innovators (2025 Edition)

The global landscape for zirconate thin-film nanocoatings is becoming increasingly competitive and innovation-driven as of 2025. With rising demand in electronics, energy, and protective coatings, both established corporations and emerging pioneers are advancing new deposition techniques, scalable manufacturing, and high-performance formulations.

Among the top manufacturers, Toshiba Corporation continues to lead in the development of zirconate-based dielectric and ferroelectric films, crucial for next-generation capacitors and memory devices. Their focus remains on optimizing pulsed laser deposition (PLD) and atomic layer deposition (ALD) processes to enhance film uniformity and scalability. Similarly, Samsung Electronics sustains its investment in integrating zirconate thin films into advanced semiconductor packaging and non-volatile memory, exploiting their high dielectric constants and thermal stability.

In the specialty chemicals domain, Merck KGaA (also known as EMD Electronics in North America) has expanded its product portfolio to include high-purity zirconate precursors for atomic layer deposition, targeting both R&D and industrial clients. Their 2024-2025 roadmap highlights partnerships with equipment makers to ensure process compatibility and purity standards for microelectronics. 3M has also moved into this space, leveraging its expertise in nanostructured coatings for high-durability, anti-corrosive, and thermal barrier applications, with an emphasis on automotive and aerospace sectors.

Innovation is also coming from specialized nanomaterials companies. NanoAmor and SkySpring Nanomaterials supply research-grade zirconate nanopowders and dispersions, supporting university and industrial labs worldwide. Their materials are integral for custom thin-film deposition experiments, particularly in energy storage and sensor applications.

On the equipment front, Oxford Instruments and ULVAC are recognized for their advanced PLD and ALD platforms, enabling precise deposition of complex oxide films, including zirconates. Their systems are widely adopted by top research institutes and pilot manufacturing lines, underscoring their role in scaling up nanocoating technologies.

Looking ahead, the outlook for zirconate thin-film nanocoatings is robust, with increased focus on integration into flexible electronics, solid-state batteries, and protective layers for harsh environments. Notably, collaborative ventures between manufacturers and end-users are expected to accelerate, aiming to translate laboratory-scale breakthroughs into commercial-scale solutions by 2027. As regulatory and sustainability pressures mount, companies investing in eco-friendly precursors and energy-efficient deposition methods are likely to gain competitive advantage.

Emerging Applications: Electronics, Energy, Aerospace, and Beyond

Zirconate thin-film nanocoatings are rapidly finding expanded applications across electronics, energy, aerospace, and related advanced technology sectors as of 2025. The unique combination of high thermal stability, chemical inertness, and exceptional dielectric properties make zirconate-based coatings particularly attractive for industries demanding robust performance under extreme conditions.

In electronics, zirconate thin films, such as barium zirconate and strontium zirconate, are increasingly utilized as high-k dielectric layers in next-generation semiconductor devices and capacitors. Their high dielectric constants and low leakage current properties have been leveraged by manufacturers aiming to miniaturize components without sacrificing reliability or efficiency. Several major electronics material suppliers have reported scaling up production of zirconate-based precursors specifically tailored for atomic layer deposition (ALD) and pulsed laser deposition (PLD) techniques, which are essential for creating ultra-thin, uniform coatings for integrated circuits and microelectromechanical systems (MEMS). As device architectures move toward sub-5 nm nodes, the demand for novel dielectric materials including zirconates is expected to intensify, with collaborations between electronics manufacturers and specialty chemical firms accelerating innovation in this field.

Within the energy sector, zirconate nanocoatings are gaining traction in solid oxide fuel cells (SOFCs) and advanced battery systems. Their ability to function as protective barriers and ionic conductors at elevated temperatures is critical for improving operational lifespans and overall system efficiency. Companies specializing in energy storage and conversion technologies are actively exploring zirconate coatings to suppress interfacial degradation and enhance ionic conductivity in both anode and cathode materials. Notably, zirconate-coated separators and electrodes are being evaluated for their potential to address dendrite growth and thermal runaway issues in lithium and sodium batteries, promising safer and longer-lasting energy storage solutions.

In aerospace and defense, the focus on lightweight, durable, and thermally stable materials is driving the adoption of zirconate thin films as thermal barrier coatings (TBCs) for turbine blades, exhaust systems, and hypersonic vehicles. Their superior resistance to oxidation and phase transformation at temperatures exceeding 1,200°C positions zirconate coatings as a next-generation alternative to traditional yttria-stabilized zirconia (YSZ). Aerospace manufacturers and engine OEMs are collaborating with advanced ceramics companies to develop zirconate-based TBCs for deployment in both commercial and military platforms.

Looking ahead, continued investment in scalable deposition technologies and the integration of artificial intelligence-driven materials discovery are expected to accelerate the commercialization of zirconate nanocoatings. Key players such as Tosoh Corporation and Ferro Corporation are expanding their advanced ceramics portfolios, while organizations like 3M are exploring multi-functional hybrid coatings that leverage zirconate’s unique properties for applications ranging from environmental protection to high-frequency communications. The next few years will likely see zirconate thin-film nanocoatings transition from specialty solutions to mainstream materials in high-performance industries.

Competitive Landscape: Company Strategies and Recent Partnerships

The competitive landscape for zirconate thin-film nanocoatings in 2025 is characterized by a blend of established multinational materials science companies and agile niche innovators, each leveraging strategic partnerships and technology advancements to capture growth opportunities. Major players are focusing on expanding their intellectual property portfolios, entering cross-sector collaborations, and scaling up manufacturing for emerging applications in electronics, energy, and advanced ceramics.

Key companies such as Momentive Performance Materials and Tosoh Corporation have intensified R&D investments to optimize zirconate coating chemistries for enhanced thermal stability and corrosion resistance. These companies are securing agreements with semiconductor device manufacturers and battery producers, aiming to supply zirconate nanocoatings for next-generation chip packaging and solid-state battery components. Tosoh Corporation, for example, has reported collaborations with Asian electronics OEMs to co-develop ultra-thin zirconate films that can withstand aggressive operating environments typical of 5G infrastructure.

In parallel, FUJIFILM Corporation and 3M have made strategic acquisitions and licensing deals to broaden their surface engineering portfolios. FUJIFILM Corporation is pursuing joint ventures with university laboratories for scale-up of atomic layer deposition (ALD) techniques, targeting the high-uniformity requirements of advanced optical devices. 3M is leveraging its global manufacturing footprint to localize production of zirconate nanocoating precursors, aiming to supply regional automotive and aerospace suppliers more efficiently.

Niche technology firms, particularly in North America and Europe, are gaining traction through rapid innovation cycles and partnerships with defense and energy sectors. Startups focused on green chemistry routes for zirconate precursor synthesis have entered pilot-scale production, often with backing from government agencies or through supply agreements with larger OEMs. These collaborations are expected to accelerate commercialization timelines and drive down costs, especially as demand for high-performance coatings in hydrogen infrastructure and renewable energy storage rises.

Looking into 2025 and beyond, experts anticipate continued consolidation as leading companies acquire startups with proprietary deposition methods or unique zirconate formulations. Strategic partnerships, especially those bridging materials science and end-user industries, will likely intensify as the market pivots toward customized nanocoating solutions for emerging electronics, energy, and high-temperature applications.

Market Forecasts: Growth Projections for 2025–2030

The market for zirconate thin-film nanocoatings is poised for significant expansion from 2025 through 2030, driven by escalating demand across key industrial sectors such as electronics, energy, aerospace, and advanced manufacturing. Zirconate-based nanocoatings are increasingly favored for their exceptional thermal stability, corrosion resistance, dielectric properties, and compatibility with next-generation substrates, positioning them as alternatives to conventional oxide coatings, particularly in high-performance and miniaturized applications.

Recent years have witnessed a surge in R&D investments and pilot-scale adoption. Leading materials manufacturers and technology suppliers are scaling up their capabilities, with companies such as Tosoh Corporation and Ferro Corporation actively advancing zirconate precursor production and nanocoating technologies for electronics and specialty glass. The expansion of thin-film deposition equipment portfolios by firms like ULVAC, Inc. and Oxford Instruments plc also supports accelerated adoption in high-value applications, including microelectronic circuits, fuel cell components, and protective coatings for advanced optics.

Market projections indicate robust growth rates, with industry consensus pointing toward a compound annual growth rate (CAGR) in the range of 8–12% for zirconate thin-film nanocoatings through 2030. This trajectory is underpinned by several factors:

- Persistent miniaturization trends in electronics and photonics, necessitating ultra-thin, high-performance insulating and barrier layers.

- Expansion of renewable energy sectors—such as solid oxide fuel cells and next-generation batteries—where zirconate layers enhance efficiency and longevity.

- Heightened regulatory and OEM requirements for sustainable and durable surface treatments in aerospace, automotive, and industrial machinery.

Regionally, Asia-Pacific—led by Japan, South Korea, and China—is expected to remain the largest growth engine due to heavy investments in microelectronics manufacturing and government-backed advanced materials initiatives. Europe and North America will likewise see increased uptake, especially in the context of clean energy infrastructure and advanced manufacturing reshoring.

Outlook for the period to 2030 suggests further integration of zirconate thin-film nanocoatings into commercial supply chains, with ongoing product innovation and capacity expansions by primary producers. Strategic collaborations among coating formulators, deposition equipment manufacturers, and end-users are anticipated to accelerate qualification cycles and standardization, further driving market maturity. As a result, zirconate nanocoatings are set to become a cornerstone technology for diverse sectors seeking enhanced material performance and reliability over the next five years and beyond.

Critical Drivers: Industry Demand, Regulatory Trends & Sustainability

The adoption of zirconate thin-film nanocoatings is being propelled by several converging industry drivers, regulatory evolutions, and sustainability imperatives as of 2025. Most notably, manufacturers in aerospace, automotive, and electronics sectors are intensifying their search for advanced materials that deliver superior thermal, chemical, and corrosion resistance—attributes where zirconate nanocoatings excel. For instance, in turbine and engine applications, zirconate coatings are valued for their high-temperature stability and barrier protection, which are critical in improving fuel efficiency and reducing operational costs.

From an industry demand perspective, the shift toward electrification and miniaturization in electronics and automotive manufacturing is pushing the search for ultrathin, high-performance protective films. Zirconate thin-film coatings, often less than 100 nm thick, enable precise control of dielectric and conductive properties required in microelectronic components. As original equipment manufacturers (OEMs) pursue longer-lasting and more reliable products, the demand for such advanced coatings is projected to accelerate through 2025 and beyond.

Regulatory trends are also shaping the zirconate nanocoatings landscape. Stricter emissions and environmental compliance standards—such as those being updated in the European Union and United States—are prompting industries to replace hazardous chromate and phosphate-based coatings with safer, high-performance alternatives. This transition is spurring the adoption of zirconate coatings, which are generally recognized as more environmentally benign. Regulatory bodies continue to tighten permissible limits on volatile organic compounds (VOCs) and heavy metal content in coatings, reinforcing the appeal of zirconate-based solutions for manufacturers seeking to future-proof their processes.

Sustainability considerations are another critical driver. The growing focus on lifecycle management and end-of-life recycling is pushing companies to adopt coatings that not only extend component life but also facilitate easier recycling and less environmental impact. Zirconate thin-film technologies, often applied via low-waste techniques such as atomic layer deposition (ALD) or chemical vapor deposition (CVD), align with these goals by minimizing material usage and waste generation. Leading suppliers in the sector, such as Tosoh Corporation and Merck KGaA, are investing in scalable, sustainable production processes to meet anticipated demand surges.

Looking ahead, these combined factors are expected to drive robust growth in the zirconate nanocoatings market over the next several years. The dual push from regulatory compliance and industrial demand, coupled with advances in deposition technology, is likely to further entrench zirconate thin films as a preferred solution across critical high-performance applications.

Barriers & Challenges: Technical, Economic, and Supply-Chain Risks

Zirconate thin-film nanocoatings, valued for exceptional chemical, thermal, and corrosion resistance, are attracting significant attention in sectors such as electronics, automotive, and energy. However, as the industry heads into 2025 and beyond, several barriers and challenges—technical, economic, and supply-chain related—could impede wider adoption and commercialization.

Technical Barriers: Achieving uniform, defect-free zirconate coatings at the nanoscale remains a complex task. Deposition methods such as atomic layer deposition (ALD) and pulsed laser deposition (PLD) require precise control of parameters to ensure homogeneity and adherence to substrates, especially on complex geometries. Reproducibility across large surface areas and diverse substrates is still a challenge, particularly for advanced applications in microelectronics. Long-term durability under real-world operational stresses is another concern, as nano-thicknesses can lead to pinholes and premature degradation. Furthermore, the integration of zirconate layers with other functional materials—such as in multilayer barrier stacks—demands careful management of interfacial properties to avoid delamination or unwanted phase reactions.

Economic Challenges: The cost of high-purity zirconium precursors and the capital investment required for advanced deposition equipment can be prohibitive, especially for small- and medium-sized enterprises. Manufacturing scalability is often limited by slow throughput of ALD and PLD processes, which makes it difficult to justify the transition from laboratory-scale to industrial-scale production. As a result, the cost-per-unit area of zirconate thin films remains higher than more established alternatives, such as alumina or titania coatings. These economic hurdles are particularly pronounced in price-sensitive sectors like consumer electronics and mass-market automotive components.

Supply-Chain Risks: Zirconium raw material supply is closely tied to global mining and refining operations, with significant production concentrated in a few countries. Disruptions—whether from geopolitical tensions, environmental restrictions, or logistical bottlenecks—can affect material availability and price stability. In 2025, ongoing efforts by manufacturers such as Chemours and Mineral Technologies to secure sustainable zircon sources will be critical. Furthermore, the supply of advanced precursors and high-purity chemicals for thin-film fabrication is dependent on specialized chemical suppliers, potentially introducing additional single-source vulnerabilities.

Outlook: Looking forward, addressing these challenges will require collaborative R&D, particularly in developing scalable deposition techniques and robust supply agreements. Industry initiatives to improve precursor recycling and localize production may help buffer supply-chain risks. Nonetheless, until technical and economic barriers are substantially reduced, widespread adoption of zirconate thin-film nanocoatings will likely remain concentrated in high-value, performance-critical applications.

Breakthrough Research & Patents: Latest Developments from Industry Leaders

In 2025, zirconate thin-film nanocoatings are at the forefront of advanced materials research, driven by their unique properties such as high thermal stability, corrosion resistance, and ionic conductivity. Industry leaders and research institutions are accelerating efforts to translate laboratory breakthroughs into scalable commercial applications, particularly for energy, electronics, and aerospace sectors.

One of the most notable advancements is the integration of atomic layer deposition (ALD) techniques to produce ultra-thin, uniform zirconate coatings. This method enables precise control over film thickness and composition, critical for applications in solid oxide fuel cells (SOFCs) and next-generation microelectronics. Companies specializing in ALD technology and materials engineering, such as Veeco Instruments Inc. and Entegris, Inc., are actively developing scalable deposition processes to meet growing industrial demand.

Patent filings in the past year reflect this momentum. Recent disclosures from leading materials firms highlight innovations in doped zirconate nanocoatings that enhance ionic transport and reduce interfacial resistance, directly impacting the efficiency and longevity of SOFCs and lithium-ion batteries. For instance, Tosoh Corporation, a global supplier of advanced ceramics, has expanded its intellectual property portfolio around yttrium-stabilized zirconate films for thermal barrier coatings and energy storage devices. These patents focus on nanostructuring techniques that boost both mechanical durability and electrochemical performance.

Collaborative research initiatives are also shaping the landscape. Partnerships between industrial players and academic institutions have yielded prototype coatings with tailored porosity and enhanced adherence to metallic and ceramic substrates. Organizations such as 3M are publicly documenting ongoing development of zirconate nanocoatings for high-temperature environments, targeting aerospace turbine blades and automotive applications.

Looking ahead to the next few years, the commercialization outlook is strong. As pilot-scale manufacturing lines for zirconate nanocoatings become operational, focus is shifting toward quality control and integration with existing component manufacturing. Industry consortia and standards bodies, including ASM International, are coordinating to establish testing protocols and reliability benchmarks, which will be crucial for widespread adoption in regulated industries.

Overall, 2025 marks a pivotal year for zirconate thin-film nanocoatings, with industry leaders consolidating their patent positions and ramping up research-to-market strategies. Continued innovation, combined with increasing standardization efforts, is expected to drive broader implementation across energy, electronics, and high-performance engineering sectors in the near future.

Future Outlook: Disruptive Trends & Investment Hotspots Through 2030

Zirconate thin-film nanocoatings are poised for significant technological and commercial advancements through 2030, driven by their exceptional thermal stability, chemical resistance, and dielectric properties. In 2025, the sector is witnessing a shift from lab-scale experimentation to scalable industrial applications, particularly in microelectronics, aerospace, and advanced energy devices. This transition is accelerated by strategic investments from leading materials manufacturers and the growing demand for next-generation electronics that require robust surface protection and enhanced performance.

One disruptive trend is the integration of zirconate thin films in semiconductor fabrication, where their high-k dielectric characteristics address the scaling challenges of transistor miniaturization. Emerging supply chain partnerships are evident, as major players such as Tosoh Corporation and Merck KGaA expand their advanced materials portfolios to include zirconate-based precursors and coatings. These companies are actively investing in R&D and pilot-scale production to meet the needs of chip manufacturers targeting sub-5nm technology nodes.

In parallel, the aerospace sector is exploring zirconate thin films for thermal barrier applications on turbine components, leveraging their superior resistance to oxidation and phase stability at extreme temperatures. Organizations such as GE Aerospace and Safran are reportedly evaluating advanced zirconate coatings in next-gen engine platforms to extend service intervals and boost fuel efficiency. This is expected to open a new investment hotspot, with supply chain localization and joint ventures targeting specialized deposition technologies like atomic layer deposition (ALD) and pulsed laser deposition (PLD).

Energy storage and conversion devices represent another frontier, as zirconate nanocoatings enhance the stability and ionic conductivity of solid-state electrolytes. Companies such as Toshiba Corporation are pursuing collaborations to optimize these coatings for lithium and sodium ion batteries, with pilot deployments anticipated by 2026. The resulting increase in device longevity and safety aligns with global electrification and decarbonization goals, attracting both venture capital and government funding to accelerate commercialization.

Looking ahead to 2030, the convergence of zirconate thin-film nanocoatings with smart manufacturing and digital process control will likely yield new functional coatings with tunable properties. Regions in East Asia, Europe, and North America are emerging as innovation hubs, where public-private partnerships and advanced materials consortia are set to drive breakthroughs in deposition uniformity, scalability, and environmental sustainability. As intellectual property portfolios deepen and supply chains mature, zirconate nanocoatings are expected to become a cornerstone in the evolution of high-performance, resilient materials across multiple high-growth sectors.